What will happen to the B2B advertising landscape in the US?

Not As Expected

GDPR is like the big brother that went off to college, and soon we’ll be following in his footsteps. The US is watching Europe to evaluate the impact GDPR has on digital advertising. According to a study conducted by Prohaska Consulting, publishers saw less than a 2% opt-out rate in the first 6 months of the regulation being in effect, and fewer than 95 fines have been levied, most at insignificant levels; this tells us that the impact is far less than was expected. GDPR was also very highly anticipated, giving companies and consumers alike over a year to fully prepare. But the effects, especially regarding changes in consumer behavior, were not as staggering as many would have thought. What does that mean for the US?

It’s Our Turn

It’s our turn to graduate and take on the big leagues. The California Consumer Protection Act (CCPA) is on its way, aiming to provide increased support and protection to consumers regarding their data and the way companies use it in their advertising strategies. But given the negligible changes consumers made in light of GDPR – a 2% opt-out rate shows minimal behavior change – we might be able to expect a similar reaction here in the US. Extrapolating the impact of GDPR in Europe to encompass the CCPA’s effect in the US is speculation that isn’t foolproof, but it is important to note that given the opportunity to take action, consumers were mostly okay with their current data relationships and didn’t opt out as often as we may have expected.

This doesn’t mean there’s nothing to worry about. Of course privacy matters – it always has and it always will. If consumers in the US opt out at a higher rate and take more action in preventing their data from being used in certain ways, then the US advertising market will see more ripples in the water. Some boats won’t survive the storm; others will. What will be the difference?

You Don’t Always Need a Bigger Boat

The size of the company won’t be the determining factor in who can survive and who can’t. The difference will lie in the technology, experience, and relationships already formed. For example, if a large company has spent years perfecting its technology, garnering experience on how to optimize campaigns, and nurturing relationships with data providers, but the foundation of the data is mostly or fully cookie-based, and the data includes personal identifiers, that company needs to start from scratch. Their technology will need to be altered greatly to incorporate different elements, their experience will have to shift, and new relationships will need to be formed. All of this will take time and will increase costs until they are able to figure out how to work around the regulations – if at all.

Instead of finding a company that is willing to work around the regulations, it would behoove agencies and brands to find one that is already complying, which could simply be the result of the nature of their operations. For example, B2B digital advertising doesn’t require personal data in order to achieve specificity OR scale. Deploying B2B digital ads does not have to involve manipulation of consumer data, nor does it have to set the end user up for risk. B2B digital advertisers with a comprehensive solution that incorporates business IP targeting with offline data and other opted-in first-party data can achieve scale that is not attainable purely with cookies. Relying solely on cookies is not the best approach in this landscape, especially with all of the changes being made to our browsers.

A Cookie Diet

Cookies and fingerprinting are both being attacked by regulations being implemented in new releases set forth by the US’s most popular browsers. Google Chrome is increasing the ease with which users can block or clear third-party cookies and is making it harder for third parties to identify individuals through browser fingerprinting, by which details that help the page appear in the browser appropriately (think the user’s OS, IP address, language, fonts, etc.) are instead by used to uniquely identify the user (source). Google’s cookie controls require opt-in, while the fingerprinting changes will be done by default. Additionally, Apple is planning to release Apple Safari ITP 2.2 later this year, which will limit the use of cookies. Firefox is also planning increased privacy protections to prevent fingerprinting techniques and perhaps limit cookie use. Chrome may not decide on the lifetime of a cookie in its privacy efforts, while Safari keeps shortening a cookie’s expiration date with each ITP release. Users will also be able to download a browser extension to see what data is being used to target ads they see.

Without being able to rely on cookies, how will ad companies target individuals?

A cookie diet is coming, and companies that want to survive must respond. Luckily for the B2B advertising market, if consumers choose to opt out of their cookies being captured and used to learn about their behaviors, there are other ways to deliver ad impressions to them without identifying their personal data. B2B digital advertising companies like AdDaptive have been doing it for years.

B2B Advertisers Can Target Anonymously at Scale

Consumers will be able to clear cookie data from their browsers after an increasingly shortened period of time. Hammering down on fingerprinting will prevent companies from using browser data to learn about the end user. And privacy laws like CCPA are trying to prevent companies from being able to tie a user’s name to his or her behaviors and personal data, especially when targeting with ads. So how will companies show the right people their advertisements at scale?

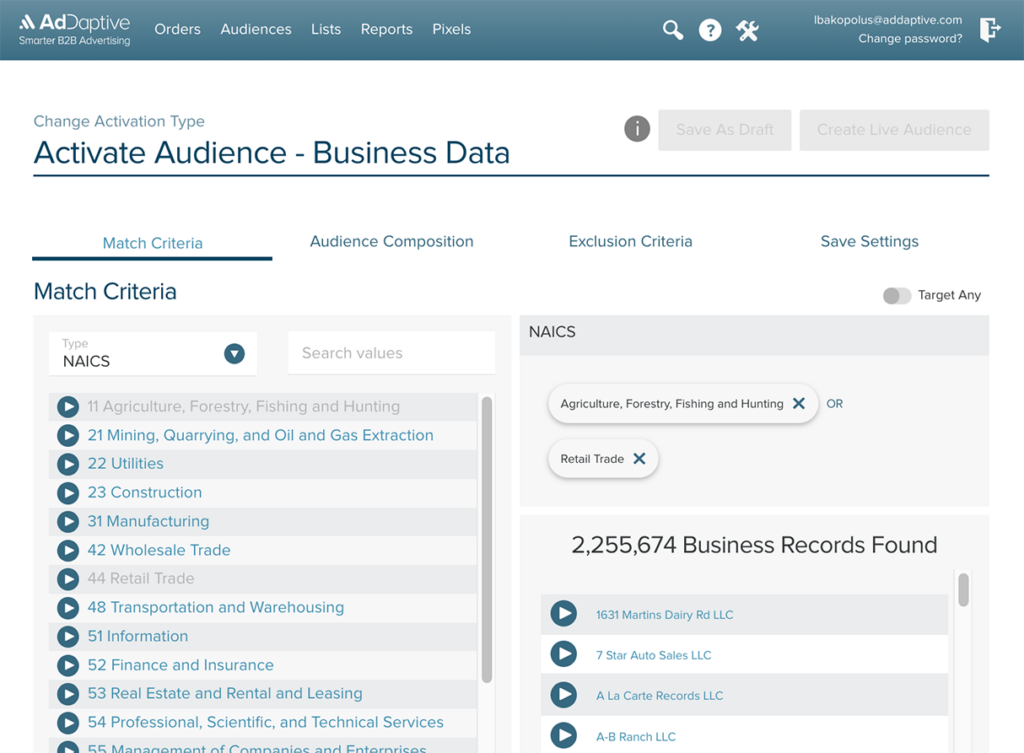

B2B Advertising can be done anonymously. Focusing on firmographics, companies can use business-related data – such as the location of an office, the IP address of computers tied to that office, the revenue and number of employees of that company, and more – to target a position at a particular company without ever knowing the name of the person filling that role. In that way, the business’s publicly available information is being leveraged, and digital identifiers are being mapped to opted-in or other legally collected data, in order to target the right people at the right business – protecting the personal behaviors and data of the user at that company.

The US B2B Digital Advertising Landscape

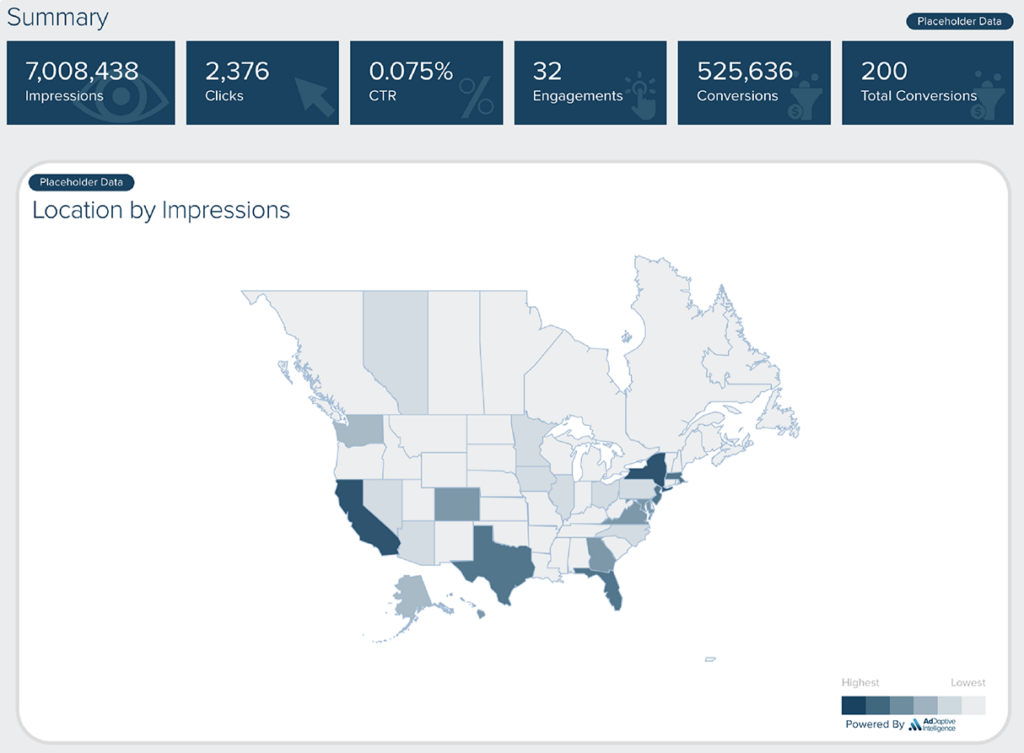

Privacy and digital regulations will affect us all – there’s no denying that. But the new rules of the game impose restrictions on certain practices that some companies already ruled out because a) there were other ways to be more successful or b) they identified safer ways of doing business. Companies like AdDaptive already have a competitive advantage because they don’t rely solely on the cookie data that may become obsolete or at least damaged in a way that will negatively impact scale. Instead, AdDaptive can achieve scale and accuracy in connecting advertisers to their target business accounts – and we can give you increased transparency about how those ads performed post-campaign. The data we use and provide is all business-centric and does not infringe on end users’ personal privacy, which protects us from the storm.

In taking a long-term view, the industry may consolidate. Companies may have to pivot or exit. Switching costs will rise. Buyers will become savvier in their approaches. Leadership will demand better analytics. Companies will need better scale in order to see positive results. And changes will continue to be made to protect individuals’ privacy. Agencies and brands that want to get ahead of the changes should evaluate their buying strategy and find companies that are already complying and thriving, succeeding in delivering B2B digital advertisements without compromising any personal data. Whether the changes in the industry are drastic or minimal, the best advice agencies and brands can get at this point in time is to work with a company that is already privacy-focused, already achieving success without infringing on personal data, and already experienced in adapting to environmental factors. Regardless of size or even brand equity, the company that is doing this for their current clients will be able to bring you similar success and help you survive the changes in the industry. AdDaptive is one such company is happy to talk with you about how we can bridge that gap and set you up for success.

Let’s talk.